Introduction

Navigating retirement savings can feel daunting for many investors. The choices available might seem complex at first glance. Understanding how to maximize your wealth is a common challenge. Two prominent options often stand out: the 401(k) and the Roth IRA. Both are powerful tools for long-term financial security. However, they differ significantly in their tax treatment and flexibility. Choosing between them, or deciding to use both, requires careful consideration. This decision impacts how quickly your retirement savings grow. It also affects how much you pay in taxes now and in the future. This article will explore both accounts in detail. We will compare their features and help you determine which might be better for your unique financial situation. Ultimately, the goal is to build wealth faster and more efficiently.

Understanding the 401(k)

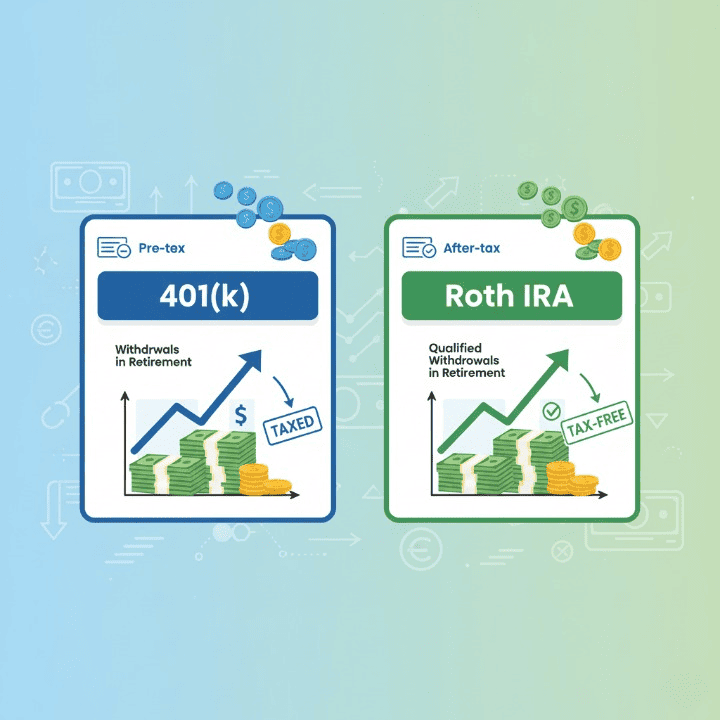

The 401(k) is a popular employer-sponsored retirement plan. It allows employees to save and invest for retirement. Contributions are typically made on a pre-tax basis. This means money goes into your account before taxes are withheld. This lowers your taxable income in the present year. This immediate tax deduction can be a significant benefit. It reduces your current income tax liability. Many employers offer a matching contribution. This is essentially free money for your retirement. For instance, an employer might match 50% of your contributions. This could be up to 6% of your salary. Always contribute at least enough to get the full employer match. Missing this match is leaving money on the table.

Your investments within a 401(k) grow tax-deferred. You do not pay taxes on earnings each year. Taxes are only paid when you withdraw funds in retirement. Withdrawals are taxed as ordinary income. You generally cannot touch the money before age 59½ without penalty. Early withdrawals often incur a 10% penalty. This is in addition to regular income taxes. Required Minimum Distributions (RMDs) typically begin at age 73. These rules ensure you eventually pay taxes on your deferred income.

Contribution limits for a 401(k) are relatively high. For 2024, individuals can contribute up to $23,000. Those aged 50 and over can contribute an additional $7,500. This is known as a catch-up contribution. These higher limits allow for substantial savings growth. The investment options are usually curated by the employer. They often include a selection of mutual funds and exchange-traded funds (ETFs). Diversification across different asset classes is key. This helps manage risk over the long term.

Pros and Cons of a 401(k)

- Pros:

- Pre-tax contributions reduce current taxable income.

- Employer matching contributions can boost savings significantly.

- High contribution limits allow for substantial wealth accumulation.

- Tax-deferred growth allows investments to compound without annual tax drag.

- Cons:

- Withdrawals in retirement are taxed as ordinary income.

- Limited investment options selected by the employer.

- Early withdrawal penalties apply before age 59½.

- Mandatory RMDs begin at age 73.

A 401(k) is an excellent choice for those who expect to be in a lower tax bracket in retirement. It also benefits those who want to reduce their current tax burden. It is a cornerstone of many successful retirement planning strategies.

Exploring the Roth IRA

The Roth IRA operates on a different tax principle. Contributions are made with after-tax dollars. This means you pay taxes on the money now. The primary benefit comes much later. All qualified withdrawals in retirement are entirely tax-free. This includes your original contributions and all earnings. This tax-free growth and withdrawal can be incredibly powerful. It offers certainty about your tax liability in retirement. Many find this attractive for long-term financial planning.

Unlike the 401(k), the Roth IRA does not typically involve employer contributions. It is an individual retirement account. You open and manage it yourself. Eligibility for a Roth IRA depends on your Modified Adjusted Gross Income (MAGI). For 2024, individuals earning above certain thresholds cannot contribute directly. For example, if your MAGI is too high, direct contributions are phased out. However, strategies like a “backdoor Roth IRA” exist. These allow high-income earners to contribute indirectly. It involves contributing to a traditional IRA and then converting it. This circumvents the income limitations.

Contribution limits for a Roth IRA are lower than a 401(k). For 2024, the limit is $7,000. Individuals aged 50 and over can contribute an additional $1,000. This brings their total to $8,000. The investment options in a Roth IRA are extensive. You can choose almost any investment vehicle. This includes stocks, bonds, mutual funds, and ETFs. This broad flexibility allows for tailored portfolio diversification. You can align investments with your risk tolerance.

Rules for Tax-Free Withdrawals

To qualify for tax-free withdrawals, two conditions must be met:

- You must be at least 59½ years old.

- Your Roth IRA must have been open for at least five years. This is known as the “five-year rule.”

If you meet these criteria, every dollar you withdraw is tax-free. This includes all accumulated earnings. This makes the Roth IRA an excellent choice. It is especially beneficial if you anticipate higher tax rates in retirement.

Pros and Cons of a Roth IRA

Here’s a summary of its advantages and disadvantages:

- Pros:

- Tax-free withdrawals in retirement, including all earnings.

- No Required Minimum Distributions (RMDs) for the original owner.

- Contributions can be withdrawn tax-free and penalty-free at any time.

- Extensive investment options provide greater control and diversification.

- Excellent for those who expect to be in a higher tax bracket in retirement.

- Cons:

- Contributions are made with after-tax dollars, no immediate tax deduction.

- Income limitations apply for direct contributions.

- Lower contribution limits compared to a 401(k).

- No employer matching contributions.

The Roth IRA is a powerful tool for building tax-free wealth. It provides significant flexibility. It is particularly appealing for younger investors. Those earlier in their careers often face lower current tax rates.

Key Differences and Comparisons: 401(k) vs. Roth IRA

Deciding between a 401(k) and a Roth IRA involves understanding their core distinctions. Both are crucial investment accounts for retirement. Yet, their mechanisms for building wealth differ significantly. The fundamental difference lies in their tax treatment. This impacts your finances now and in the future.

Tax Treatment: Pre-Tax vs. After-Tax

The most prominent difference is when you pay taxes.

- A 401(k) typically uses pre-tax contributions. Your contributions reduce your current taxable income. This means you save on taxes today. Your investments grow tax-deferred. You pay taxes on all withdrawals in retirement. These are taxed as ordinary income. This strategy is beneficial if you believe you are in a higher tax bracket now. You might expect to be in a lower tax bracket during retirement.

- A Roth IRA uses after-tax contributions. You pay income taxes on your contributions now. This means no immediate tax deduction. However, all qualified withdrawals in retirement are entirely tax-free. This includes your contributions and all earnings. This approach is advantageous if you expect to be in a higher tax bracket in the future. Younger investors often find this appealing. They usually anticipate their income growing over their careers.

Employer Matching and Contribution Limits

Employer matching is a significant factor.

- Only a 401(k) typically offers employer matching contributions. This “free money” is a powerful incentive. It can substantially accelerate your wealth building. Always contribute enough to receive the full match.

- A Roth IRA does not have employer matching. It is an individual account.

Contribution limits also vary.

- The 401(k) has higher annual contribution limits. For 2024, it is $23,000. It also offers larger catch-up contributions for those aged 50 and over.

- The Roth IRA has lower limits. For 2024, it is $7,000. It also has smaller catch-up contributions.

Income Limitations and Flexibility

Eligibility is another key differentiator.

- There are no income limitations for contributing to a 401(k). Anyone whose employer offers one can contribute.

- The Roth IRA has income limitations for direct contributions. High-income earners may need to use a “backdoor Roth” strategy.

Regarding flexibility:

- A Roth IRA offers more investment flexibility. You choose your own investments. It also allows tax-free and penalty-free withdrawal of contributions at any time. This can serve as an emergency fund in a pinch.

- A 401(k) generally has limited investment options. These are chosen by your employer. Early withdrawals are usually subject to penalties.

Which Builds Wealth Faster?

The question of which account builds wealth faster lacks a universal answer. It largely depends on individual circumstances.

- If you prioritize immediate tax savings and expect lower taxes in retirement, the 401(k) might seem faster initially. The employer match also provides an immediate boost.

- If you anticipate higher taxes in retirement and value tax-free withdrawals, the Roth IRA could lead to more net wealth. Its tax-free growth means no taxes on gains. This is a significant advantage over many decades.

Many financial experts recommend a balanced approach. This often involves contributing to both. Maximize your 401(k) employer match first. Then, consider contributing to a Roth IRA. This dual strategy combines the best of both worlds. It optimizes your retirement savings for various future tax scenarios.

Strategies for Maximizing Retirement Wealth

Building substantial wealth for retirement involves more than just choosing the right account. It requires a comprehensive strategy. Combining intelligent savings habits with smart investment decisions is crucial. This section explores key strategies to accelerate your retirement savings.

Prioritize Employer Match

As mentioned, always contribute enough to your 401(k) to receive the full employer match. This is immediate, guaranteed returns on your investment. It is essentially free money. Failing to do so is a missed opportunity. This should be the first step in your retirement savings plan. It provides a significant boost to your overall wealth building efforts.

Diversification and Asset Allocation

Diversification means spreading your investments across various asset classes. This includes stocks, bonds, and potentially real estate. It helps reduce risk. If one investment performs poorly, others might perform well. Asset allocation is deciding what percentage of your portfolio goes into each asset class. This allocation should reflect your age, risk tolerance, and time horizon. Younger investors might have a higher allocation to stocks. They have more time to recover from market downturns. As you approach retirement, you might shift towards more conservative investments. These typically include bonds. Rebalancing your portfolio periodically is also important. This ensures it stays aligned with your financial goals.

Embrace Compounding Interest

Albert Einstein reportedly called compound interest the eighth wonder of the world. It is the process of earning returns on your initial investment and on the accumulated interest from previous periods. The earlier you start investing, the more powerful compounding becomes. Even small, consistent contributions can grow into significant sums over decades. Time is your greatest asset in retirement planning. For example, $100 invested today at 7% annual return is worth much more in 30 years. It will have grown through the magic of compounding.

Consider Both Accounts: A Hybrid Approach

Many investors find a combination of a 401(k) and a Roth IRA to be the most effective.

- Start by contributing to your 401(k) up to the employer match. This secures the “free money.”

- Next, maximize your contributions to a Roth IRA. This provides tax-free growth and withdrawals. It also offers more investment flexibility.

- If you still have funds available, contribute more to your 401(k). Consider a Roth 401(k) if available. This combines the high contribution limits of a 401(k) with the tax-free withdrawals of a Roth.

- This hybrid strategy offers flexibility for future tax scenarios. It also hedges against uncertainty.

Regularly Review and Adjust

Your financial situation and goals will change over time. It is crucial to regularly review your retirement plan.

- Assess your contributions. Are you saving enough to meet your retirement goals?

- Review your investment performance. Are your chosen funds performing as expected?

- Re-evaluate your asset allocation. Does it still match your risk tolerance and time horizon?

- Stay informed about changes in tax laws or contribution limits.

Consistent monitoring and adjustments ensure your wealth building strategy remains on track. It maximizes your chances of a comfortable retirement.

Conclusion

Choosing between a 401(k) and a Roth IRA is a fundamental decision in retirement planning. Both are invaluable tools for building wealth. However, their unique tax treatments cater to different financial situations. The 401(k) offers immediate tax deductions and employer matching. Its tax-deferred growth can significantly boost savings. It is ideal for those expecting lower tax rates in retirement. Conversely, the Roth IRA provides tax-free withdrawals in retirement. It is perfect for individuals anticipating higher future tax rates. Its flexibility and extensive investment options are also attractive.

Ultimately, there is no single “best” answer. Your optimal choice depends on several factors. These include your current income, expected future tax bracket, and financial goals. Many experts advocate a diversified approach. This often means contributing enough to your 401(k) to get the employer match. Then, you might maximize contributions to a Roth IRA. This hybrid strategy offers a balanced approach. It can effectively leverage the benefits of both accounts. This protects against future tax uncertainties.

Regardless of your choice, the most crucial step is to start saving early. Embrace the power of compounding interest. Regularly review and adjust your investment strategy. Seek professional financial advice if needed. Building wealth for retirement is a marathon, not a sprint. Consistent effort and informed decisions are key. They will help you secure a financially comfortable future. Make these decisions with foresight and diligence. Your future self will thank you for it.