Introduction

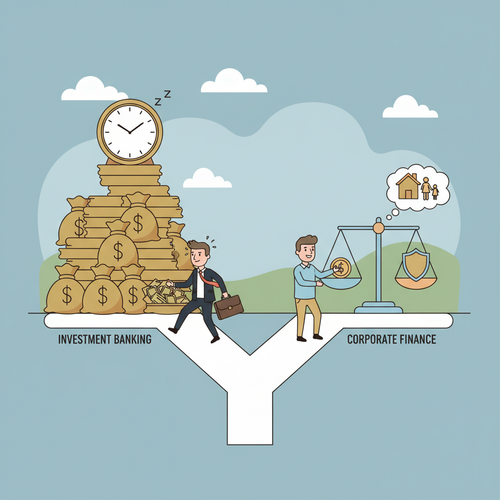

Many aspiring financial professionals grapple with a crucial decision: pursue a career in corporate finance or dive into investment banking? Both paths offer significant opportunities. However, they differ profoundly in daily responsibilities, work-life balance, and ultimately, compensation. Understanding these distinctions is vital for making an informed career choice.

This article will explore the unique aspects of each field. We will compare their career trajectories and provide a detailed salary comparison. This analysis of career paths in corporate finance versus investment banking will help you align your professional aspirations with the realities of the financial world.

Understanding Corporate Finance

Corporate finance focuses on managing a company’s financial resources. It involves strategic decisions about capital structure, investments, and financing. Professionals in this field work within a company. They ensure its long-term financial health and growth. Their primary goal is to maximize shareholder value. This is achieved through efficient allocation of capital and risk management.

This area of finance supports the entire organization. It helps businesses operate smoothly and strategically. Corporate finance is less about external deals. It focuses more on internal financial operations. It is a cornerstone of business success. Every company, regardless of size, needs robust corporate finance functions.

Typical Roles and Responsibilities

Corporate finance encompasses a variety of critical roles. Each role contributes to the company’s financial strategy. Let’s explore some common positions and their responsibilities:

- Financial Planning & Analysis (FP&A): This team handles budgeting, forecasting, and performance analysis. They provide insights to senior management. Their work informs strategic business decisions. FP&A professionals are crucial for financial health.

- Treasury: Treasury departments manage a company’s cash flow, liquidity, and financial risks. They optimize working capital. They also handle relationships with banks. Effective treasury management protects company assets.

- Investor Relations (IR): IR professionals manage communication between the company and its investors. They articulate the company’s financial story. They also address shareholder concerns. Good IR builds investor confidence.

- Internal Audit: These teams ensure compliance with financial regulations and internal policies. They identify areas for process improvement. Internal auditors safeguard company integrity.

These roles require a blend of analytical skills and strategic thinking. They are essential for any thriving business.

Career Progression in Corporate Finance

A career in corporate finance typically follows a well-defined path. It starts at an entry-level position. Then it moves up to senior management. Progression is often steady. It also offers a relatively predictable work-life balance compared to investment banking.

The path usually moves from Analyst to Senior Analyst. Then, one becomes a Manager, followed by Director. Finally, the top roles are VP of Finance and Chief Financial Officer (CFO). This trajectory emphasizes internal growth and deep company knowledge. It values long-term commitment. Many professionals appreciate the stability here.

Exploring Investment Banking

Investment banking involves providing financial advisory services. These services are offered to corporations, governments, and institutions. Investment banks facilitate large, complex financial transactions. Their core functions include capital raising and mergers and acquisitions (M&A). They act as intermediaries in financial markets. These institutions are central to global finance.

Investment bankers help clients achieve their strategic financial goals. They might advise a company on going public. Or they might help another acquire a competitor. The work is dynamic and often high-stakes. Therefore, it demands exceptional analytical and communication skills.

Key Functions and Departments

Investment banks are structured into various specialized departments. Each department plays a distinct role. Here are some of the primary functions:

- Mergers & Acquisitions (M&A) Advisory: This department advises companies on buying, selling, or merging with other entities. They guide clients through complex deal processes.

- Capital Markets (ECM/DCM): Helps companies raise capital. This includes initial public offerings (IPOs) and bond issuances.

- Sales & Trading: Professionals in this area facilitate the buying and selling of securities. They act as market makers and provide liquidity.

- Research: Equity research analysts provide in-depth analysis of companies. They make buy, sell, or hold recommendations.

These departments often collaborate on large transactions. The environment is fast-paced. It requires quick thinking. It also demands a strong grasp of financial markets.

Salary Comparison: Corporate Finance vs. Investment Banking

One of the most significant differences between these two paths lies in compensation. Investment banking generally offers higher salaries and bonuses. Corporate finance provides a more stable, albeit typically lower, compensation structure. Let’s break down the expected earnings at various career stages.

Entry-Level Compensation

At the entry-level, the salary disparity becomes immediately apparent. Investment banking analysts often see base salaries from $100,000 to $150,000. With bonuses, total compensation can reach $250,000. Conversely, a corporate finance analyst might start with a base of $60,000 to $90,000. Their total package usually falls between $70,000 and $110,000.

The upfront financial reward in investment banking is substantially higher. This reflects the demanding hours and high-pressure environment.

Mid-Career Compensation

As professionals advance, the gap in compensation widens further. An Investment Banking Vice President can earn between $400,000 and $1,000,000 annually. This depends heavily on deal flow. In contrast, a Corporate Finance Director typically earns between $150,000 and $280,000. While substantial, it is lower than banking. Mid-career investment bankers significantly out-earn their counterparts.

Senior-Level Compensation

At the highest levels, both paths offer very strong compensation. However, investment banking still maintains an edge. Managing Directors in banking can earn millions. CFOs of large corporations also earn millions, but these roles are scarcer. For a detailed breakdown across roles, sources like Robert Half provide comprehensive guides.

Work-Life Balance and Culture

Beyond salaries, the day-to-day experience is drastically different. This often becomes a deciding factor for many professionals exploring career paths in corporate finance.

Investment Banking Demands

Investment banking is infamous for its demanding work schedule. Professionals routinely work 80-100+ hours per week. Weekends and late nights are common. The environment is high-pressure and client-driven. Deadlines are tight. There is also a strong emphasis on speed and accuracy. The culture is highly competitive.

Corporate Finance Lifestyle

Corporate finance generally offers a more predictable lifestyle. Typical workweeks range from 40-60 hours. While busy periods exist, they are less intense. The culture is often more collaborative. There is a greater emphasis on long-term strategy. This environment allows for more personal time. It fosters deeper relationships within the company. Many find this balance highly appealing.

Which Path is Right for You?

Choosing between career paths in corporate finance and investment banking is personal. It depends heavily on your priorities and career aspirations.

Consider Your Priorities

Think carefully about what you value most. Are you willing to sacrifice personal time for high compensation? Or do you prefer stability and manageable hours? Where do you see yourself in 10 years? Investment banking often leads to private equity. Corporate finance can lead to a CFO role. Reflecting on these questions clarifies your preferences.

Skills and Personality Match

Your natural aptitudes also play a role. Investment banking requires resilience and high energy. You must handle immense pressure. Corporate finance suits those who are strategic and collaborative. They enjoy problem-solving within an organization. Choosing the right fit ensures job satisfaction. It also increases the likelihood of long-term success. Further insights can be found on reputable sites like the Financial Times.

Conclusion

The choice between career paths in corporate finance and investment banking is pivotal. Investment banking offers exhilarating challenges and high pay. However, it comes at the cost of intense pressure. Corporate finance provides stability and better work-life balance. While compensation is generally lower, it remains lucrative at senior levels. Your decision should align with your personal values. Evaluate your priorities carefully. Understand the distinct demands of each path. This will enable you to forge a fulfilling career in finance.