Navigating the world of student debt can feel overwhelming. Specifically, consolidating private student loans presents both opportunities and challenges. This financial decision requires careful consideration. Therefore, understanding its implications is crucial for beginner investors seeking financial stability.

What is Private Student Loan Consolidation?

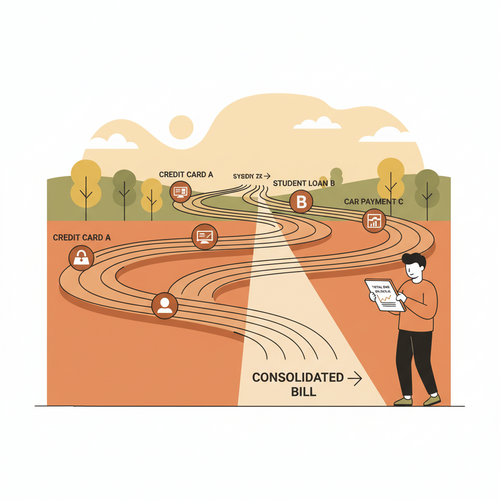

Private student loan consolidation essentially involves taking out a new loan. This new loan pays off all your existing private student loans. Consequently, you are left with just one monthly payment. Often, this new loan comes from a private lender. It is distinct from federal loan consolidation. Federal programs offer different benefits and structures. Conversely, private consolidation focuses on market rates and borrower creditworthiness. Indeed, eligibility often depends on your credit score and income. Many people seek this option to simplify their finances. Furthermore, it might offer more favorable terms. Beginner investors must grasp this fundamental concept. Thus, informed choices become possible.

The Pros of Consolidating Private Student Loans

Potentially Lower Interest Rates

One primary benefit of consolidation is securing a lower interest rate. For instance, if your credit score has improved since you first took out your loans, you may qualify. A lower rate reduces the total amount you repay over time. Therefore, this translates into significant savings. Every percentage point matters. Consequently, a lower rate lightens your financial burden. Investors can then allocate more funds elsewhere. This might include retirement savings or other investments. Always compare current rates carefully.

Simplified Payments

Managing multiple loan payments can be complex. Each loan might have a different due date. Furthermore, they often have varying interest rates. Consolidating combines these into a single monthly bill. This simplification reduces the risk of missed payments. Indeed, it makes budgeting much easier. Thus, financial stress often decreases. A streamlined approach benefits everyone. Specifically, beginner investors can focus on their portfolios. They gain clarity in their debt management.

Predictable Repayment Schedule

Consolidation often establishes a new, fixed repayment term. This creates a clear timeline for becoming debt-free. For example, knowing you will be done in 10 or 15 years provides peace of mind. A predictable schedule helps with long-term financial planning. Therefore, you can set future financial goals more easily. This structure is invaluable. Indeed, it empowers borrowers. It gives a clear finish line for their debt journey.

Reduced Monthly Payments

Extending the repayment term can lower your monthly payment. While this might mean paying more interest overall, it frees up cash flow. Consequently, having more disposable income monthly can be beneficial. It allows for greater flexibility. Perhaps you can cover other essential expenses. Furthermore, it might enable you to build an emergency fund. This strategy can be helpful during tight financial periods. However, always weigh the long-term cost. It is a trade-off worth considering.

Release of Cosigner

Many private student loans require a cosigner. Consolidating can sometimes allow you to release your original cosigner. This removes their financial obligation. For instance, a parent or guardian would no longer be responsible. This is a significant benefit for both parties. It protects the cosigner’s credit. Furthermore, it gives you full ownership of your debt. Therefore, if you can qualify on your own, pursue this option. It strengthens your financial independence.

The Cons of Consolidating Private Student Loans

No Interest Rate Caps

Private loans, including consolidated ones, often lack the interest rate caps found in some federal programs. This means rates could potentially be higher. Furthermore, they might increase substantially over time. Variable rate loans carry this specific risk. Consequently, your monthly payment could fluctuate. Always understand the terms of your new loan. High-interest burdens can hinder financial progress. Beginner investors should be particularly wary of this.

Potentially Longer Repayment Term

While a longer term can reduce monthly payments, it increases the total interest paid. For example, stretching a 10-year loan to 20 years seems appealing upfront. However, the cumulative cost rises significantly. Therefore, you stay in debt for a longer period. This delays other financial milestones. Indeed, it impacts your overall wealth-building potential. Consider the total cost of the loan. Do not just focus on the monthly payment.

Variable Interest Rate Risks

Many consolidated private loans come with variable interest rates. These rates can change based on market conditions. For instance, if the prime rate increases, your loan rate will also rise. Consequently, your monthly payments become unpredictable. This unpredictability makes budgeting challenging. Furthermore, it adds financial uncertainty. A sudden rate hike could strain your budget. Therefore, carefully assess your risk tolerance. A fixed-rate loan offers more stability.

Application Fees

Some private lenders charge fees for loan origination or applications. These fees add to the overall cost of consolidation. For example, a 1-3% origination fee on a large loan can be substantial. Therefore, always inquire about all associated costs. These extra charges diminish potential savings. Ensure the benefits outweigh any fees. Transparency in costs is paramount. Do not overlook these hidden expenses.

Credit Score Impact

Applying for a new loan involves a hard credit inquiry. This can temporarily lower your credit score. Furthermore, closing old accounts and opening a new one might impact your credit history length. Consequently, a lower score could affect future borrowing. For instance, it might make getting a mortgage more difficult. Always monitor your credit. Understand the short-term implications. The long-term benefits typically outweigh the initial dip.

Loss of Borrower Protections

Private student loans offer fewer borrower protections than federal loans. This applies to consolidated private loans as well. For example, federal loans often provide income-driven repayment plans. They also offer forbearance and deferment options. Private lenders generally have stricter policies. Consequently, if you face financial hardship, your options may be limited. Always review the hardship provisions. Understand what support is available. This difference is critical for financial security.

Who Should Consider Consolidation?

Consolidation is not for everyone. Individuals with multiple private student loans might benefit most. Furthermore, those with high interest rates on existing loans are good candidates. If your credit score has significantly improved, explore this option. A stable income also strengthens your application. Conversely, if your credit is poor, consolidation might not offer better terms. Consider your long-term financial goals. This decision aligns with prudent debt management. Therefore, assess your current situation honestly. Indeed, seek expert advice if unsure.

Steps to Consolidate Private Student Loans

The process of consolidating private student loans involves several key steps. Firstly, gather all your loan documentation. This includes statements and current interest rates. Secondly, research different lenders. Look for competitive rates and favorable terms. Many online lenders specialize in student loan refinancing. For instance, reputable financial institutions like Reuters and Bloomberg provide financial news and resources. Comparing offers from multiple sources is crucial. Therefore, do not settle for the first offer. Thirdly, complete the application carefully. Provide all requested financial information. This typically includes income verification and credit history. Fourthly, review the loan agreement thoroughly. Understand all terms, conditions, and fees. Do not hesitate to ask questions. Finally, once approved, your new lender will pay off your old loans. You then begin making payments to the new lender. This streamlines your financial obligations. Indeed, it marks a significant step towards debt control. Take your time with each stage. Consult resources like Investopedia for guidance. This systematic approach ensures a smooth transition. Furthermore, it helps secure the best possible outcome. Always keep copies of all documents. Knowledge is power in financial decisions. Thus, be diligent.

Conclusion

Consolidating private student loans offers both compelling advantages and notable drawbacks. A lower interest rate and simplified payments can significantly ease your financial burden. However, potential risks exist. These include longer repayment terms and fewer borrower protections. Therefore, careful evaluation is essential. Beginner investors must weigh the pros and cons against their personal financial situation. Furthermore, consider your creditworthiness and future goals. This informed approach leads to better financial outcomes. Always conduct thorough research. Indeed, seek professional advice if needed. Making a strategic decision about your student loans is a cornerstone of effective financial planning. Ultimately, your goal is financial freedom. Thus, choose wisely.