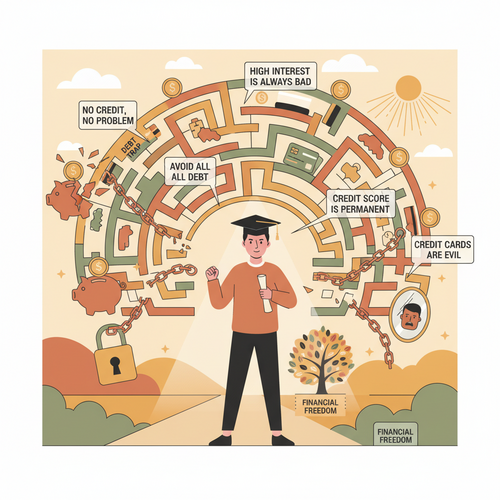

Navigating the financial world after graduation can feel like a daunting task. Specifically, understanding your credit score is crucial for securing loans, renting an apartment, or even landing certain jobs. However, many recent graduates fall prey to common credit score myths recent graduates frequently encounter. These misconceptions, furthermore, can inadvertently damage their financial standing. Indeed, separating fact from fiction is essential for building a robust financial future.

Therefore, let’s debunk five prevalent credit score myths that could significantly hurt your financial journey. Understanding these truths will empower you to make informed decisions. Consequently, you can establish a healthy credit history from the outset.

Myth 1: Carrying a Balance Helps Your Score

The Illusion of Help

Many individuals mistakenly believe that carrying a small balance on their credit card from month to month will somehow improve their credit score. This idea suggests that lenders favor seeing active, ongoing use. Furthermore, some think it demonstrates responsible credit management. However, this is a dangerous misconception.

The Reality of Utilization

In fact, carrying a balance almost always works against you. Credit utilization, which is the amount of credit you use compared to your total available credit, is a significant factor in your credit score. Generally, keeping your utilization below 30% is advisable. Ideally, experts recommend staying under 10% for optimal results. Conversely, carrying a balance often means you are utilizing a higher percentage of your available credit. This, therefore, signals a higher risk to lenders.

Consequently, high utilization can cause your score to drop. Moreover, you will incur interest charges on the carried balance, wasting money. Instead, focus on paying off your credit card balance in full each month. This strategy, indeed, shows responsible behavior and avoids unnecessary interest. Furthermore, it helps maintain a low credit utilization ratio, which positively impacts your score. For instance, always aim to pay off the entire statement balance by the due date. This demonstrates exceptional credit management to potential lenders. Learn more about sound financial practices at the Federal Reserve.

Myth 2: Checking Your Credit Score Lowers It

Fear of the Unknown

A common concern among new credit users is that simply checking their credit score will somehow penalize them. Many graduates, therefore, avoid checking their scores. This fear often stems from a misunderstanding of how credit inquiries work. Specifically, the idea of a “hit” to their score can deter them. However, this myth creates unnecessary anxiety.

Soft vs. Hard Inquiries

The truth is that there are two types of credit inquiries: soft inquiries and hard inquiries. A soft inquiry occurs when you check your own credit score. This also happens when a lender pre-screens you for an offer. Notably, soft inquiries have no impact on your credit score. Therefore, feel free to check your score regularly. Indeed, monitoring your credit is a smart financial habit. Many credit card companies, furthermore, offer free access to your FICO score.

Conversely, a hard inquiry happens when you apply for new credit. This includes loans or credit cards. Hard inquiries can cause a small, temporary dip in your score. Multiple hard inquiries in a short period, consequently, suggest you are seeking a lot of new debt. This can be viewed negatively by lenders. Thus, only apply for credit when genuinely needed. For instance, applying for several credit cards within a month could negatively impact your score. However, checking your score periodically is a protective measure, not a harmful one. Utilize available resources to stay informed. Visit the Consumer Financial Protection Bureau for reliable information.

Myth 3: Closing Old Credit Cards is Always Good

Decluttering Your Finances

After paying off an old credit card, some graduates feel a sense of accomplishment. They might then decide to close the account, believing it tidies up their financial life. This action, unfortunately, is often a mistake. Specifically, it can unexpectedly harm their credit score. Therefore, think twice before closing an old credit line.

The Age of Credit and Utilization

Two critical factors are affected when you close an old credit card. First, the length of your credit history is a significant component of your score. Older accounts contribute positively to this average age. Closing an old account, consequently, shortens your overall credit history. This can reduce your average account age. Second, closing an account reduces your total available credit. This, therefore, can instantly increase your credit utilization ratio. Even if your balances remain the same, the reduced credit limit makes your utilization percentage higher.

For instance, if you have a card with a $5,000 limit and close it, your total available credit decreases. If you previously had $10,000 total credit, you now only have $5,000. If you carried a $1,000 balance, your utilization jumps from 10% to 20%. This significantly impacts your score. Instead, keep old credit accounts open, especially if they have no annual fee. Use them occasionally to keep them active. This maintains a longer credit history and a higher total credit limit. Consequently, it helps keep your utilization low. Indeed, a long, positive credit history is highly valued by lenders. Consider this strategy for better credit management. Read financial news on Reuters for global economic insights.

Myth 4: Only Big Debts Affect Your Score

Focusing on the Obvious

Many recent graduates focus intensely on large debts, such as student loans or car payments. They correctly understand that defaulting on these big obligations would devastate their credit. However, a common myth suggests that smaller, seemingly insignificant bills do not impact credit scores. This is a dangerous oversimplification. Indeed, neglecting minor payments can have surprising consequences.

The Power of Payment History

Payment history is the most important factor in your credit score, accounting for about 35% of your FICO score. This factor considers *all* your payment obligations, not just the big ones. Therefore, even small, unpaid bills can eventually find their way onto your credit report. For instance, an overdue utility bill, a forgotten medical co-pay, or even library fines can be sent to collections. Once in collections, these items appear on your credit report. They consequently leave a negative mark.

Furthermore, consistent on-time payments, regardless of the amount, build a positive history. Conversely, late payments, even on small accounts, can significantly lower your score. It is crucial, therefore, to treat every financial obligation seriously. Ensure all bills, big or small, are paid on time. Setting up automatic payments can be a helpful strategy. This proactive approach prevents unexpected hits to your credit. Indeed, every payment contributes to your overall financial reputation. This holistic view is vital for young professionals. Stay updated on market trends with Bloomberg.

Myth 5: You Don’t Need Credit Until You Buy a House

Delayed Financial Planning

Some recent graduates believe that building credit is a task for the distant future, perhaps when they are ready to purchase a home. They might think that without immediate plans for a mortgage, there is no urgency to establish a credit history. This perspective, however, significantly underestimates the immediate and widespread utility of a good credit score. Consequently, delaying credit building can hinder various aspects of adult life.

Credit’s Pervasive Influence

In reality, your credit score influences much more than just home loans. For instance, landlords often check credit scores when you apply to rent an apartment. A low score might lead to a larger security deposit or even outright rejection. Furthermore, securing a car loan with favorable interest rates depends heavily on your creditworthiness. Car insurance premiums can also be impacted by your credit score. Many employers, specifically those in financial or security-sensitive roles, review credit reports as part of their background checks. This demonstrates financial responsibility. Therefore, a good credit score opens doors to better living arrangements, more affordable transportation, and even career opportunities.

Indeed, building credit is a continuous process. Starting early allows you to establish a long, positive history. This makes you a more attractive candidate for various financial products and services. Consequently, begin with a secured credit card or become an authorized user on a trusted family member’s account. These are excellent first steps. Regularly review your financial standing and seek expert advice. Utilize resources like Investopedia for detailed financial education.

Building a Strong Credit Foundation

Understanding these common credit score myths is just the beginning. Establishing and maintaining excellent credit requires ongoing diligence and smart financial habits. Furthermore, recent graduates have a unique opportunity to lay a strong foundation for their financial future. This proactive approach pays dividends for years to come. Therefore, consider these additional strategies to cultivate a robust credit profile.

Key Strategies for Success

- Pay Bills On Time: This is arguably the most critical factor. Consistency in making payments by their due date demonstrates reliability. Set up automatic payments to avoid missing deadlines. This simple habit, indeed, forms the backbone of good credit.

- Keep Credit Utilization Low: As discussed, aim to use less than 30% of your available credit. Paying down balances quickly is paramount. Consequently, your credit score will reflect this responsible behavior.

- Maintain a Diverse Credit Mix: Having a mix of credit types, such as installment loans (student loans, car loans) and revolving credit (credit cards), can positively impact your score. This diversity shows you can manage various forms of debt responsibly.

- Limit New Credit Applications: Apply for new credit only when necessary. Multiple hard inquiries in a short period can temporarily lower your score. Therefore, space out your applications.

- Regularly Monitor Your Credit: Check your credit report annually for errors. You can access free reports from the major credit bureaus. This vigilance helps catch fraud and rectify mistakes promptly. Indeed, it is a crucial defensive measure.

Specifically, these practices will help you build and maintain a strong credit score. Consequently, you will be better positioned to achieve your financial goals. Remember, your credit score is a reflection of your financial reliability. Managing it wisely is an investment in yourself.

Conclusion

Navigating the post-graduation financial landscape can be challenging. However, by dispelling common credit score myths recent graduates often encounter, you gain a significant advantage. Understanding the true impact of carrying balances, checking your score, closing accounts, and the scope of payment history empowers you. Furthermore, recognizing the pervasive influence of credit beyond major purchases is vital. These insights, indeed, are invaluable for young professionals.

Therefore, take control of your financial narrative. Educate yourself, adopt responsible habits, and monitor your credit diligently. A strong credit score is not merely a number; it is a gateway to financial freedom and opportunity. Consequently, apply these truths to build a resilient financial future. Indeed, your efforts today will pave the way for a more secure tomorrow. Remember, smart financial choices start now.