Introduction

As you begin your university journey, you start with a clean slate in many aspects of life, including your finances. One of the most important, yet often overlooked, of these is your credit history. Think of credit as your financial reputation. When you start, you don’t have a good or a bad one; you simply have a blank one. The financial habits you build over the next few years will write the first, most critical chapters of your financial story, creating a record that lenders, landlords, and even future employers may one day review.

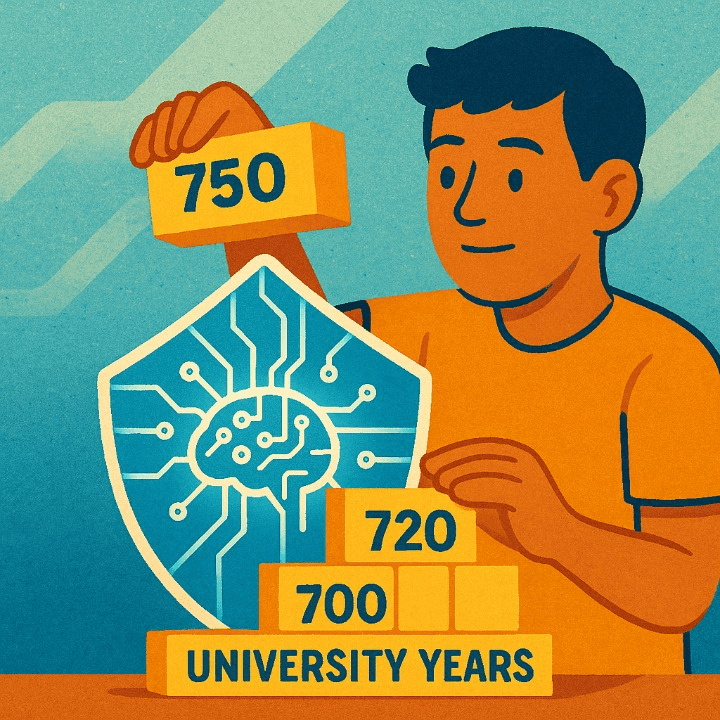

Building a strong credit score from scratch while you are a student is one of the most powerful moves you can make for your future self. It is the key that unlocks better opportunities and lower costs for years to come. This article is your step-by-step playbook for doing just that. We’ll guide you through the smartest tools, the golden rules of responsibility, and explain how a good credit score is your passport to better financing, lower rates, and long-term financial freedom.

Why Your Credit Score is Your Financial Passport

Before we dive into the “how,” let’s understand the “why.” A credit score is a three-digit number, typically ranging from 300 to 850, that summarizes your reliability as a borrower. A higher number indicates lower risk. But its impact extends far beyond just getting a loan. Your credit history can influence:

- Financing for Major Purchases: A good score is essential for getting approved for car loans or mortgages. More importantly, it qualifies you for a much lower interest rate, which can save you thousands or even tens of thousands of dollars over the life of the loan.

- Renting an Apartment: Most landlords run a credit check to see if you have a history of paying your bills on time before they will hand over the keys.

- Insurance Premiums: Many insurance companies use a credit-based insurance score to help determine your rates for car and home insurance. A better credit history can lead to lower monthly payments.

- Utility Deposits: Companies providing electricity, gas, or internet may require a security deposit if you have a poor or non-existent credit history.

In essence, a strong credit score acts as a financial passport, granting you easier and cheaper access to a world of products and services.

The Starting Line: Your First Credit Card

For a student with no credit history, the most common and effective way to start building it is with the right kind of credit card. This is not for making purchases you can’t afford; it is a tool used specifically to demonstrate financial responsibility. Here are your primary options:

- Student Credit Cards: These are the ideal starting point. Financial institutions design these cards specifically for university students. They recognize that applicants will have limited income and no prior credit history. These cards typically have a low credit limit, which is actually a good thing, as it helps prevent you from getting into too much debt.

- Secured Credit Cards: If for some reason you don’t qualify for a student credit card, a secured card is a guaranteed path to building credit. It works by requiring a refundable security deposit from you. That deposit—for example, $300—then typically becomes your credit limit. You use the card like a regular credit card, and the bank reports your responsible payments to the credit bureaus. After a year or so of responsible use, the bank will often refund your deposit and upgrade you to a regular, unsecured card.

- Becoming an Authorized User: Another strategy is to have a parent or guardian with a long and positive credit history add you as an “authorized user” on their credit card account. You get a card with your name on it, and their payment history for that account can start to appear on your credit report. The major caveat is that this is only a good idea if the primary cardholder is extremely responsible.

The Golden Rules of Using Your First Credit Card

Getting the card is the easy part. Using it wisely is what actually builds your score. Follow these three golden rules without exception:

- Rule 1: Pay Your Bill in Full and On Time, Every Single Time. This is the number one most important factor in your credit score. Payment history accounts for the largest portion of your score. Even one late payment can set you back significantly. Set up automatic payments for at least the minimum amount to ensure you are never late.

- Rule 2: Keep Your Credit Utilization Low. Your credit utilization is the percentage of your available credit that you are using. For example, if you have a $500 balance on a card with a $1,000 limit, your utilization is 50%. A high utilization ratio signals risk to lenders. A good rule of thumb is to always keep your balance below 30% of your limit.

- Rule 3: Treat It Like a Debit Card. The safest way to use a credit card when you’re starting out is to only charge purchases that you already have the cash to pay for. Do not view your credit limit as an extension of your income. Use it for small, regular purchases like groceries or gas, and then pay the balance off in full.

Understanding the Interest Rate: The Cost of Debt

The goal of using a credit-building card is not to carry a balance from month to month. If you do, you will be charged interest, and the interest rate on credit cards is notoriously high. An APR (Annual Percentage Rate) of 20% or more is common. A small, seemingly manageable balance of a few hundred dollars can quickly grow with compounding interest, making it difficult to pay off. Remember, you do not need to pay any interest to build good credit. You simply need to use the card and pay it off in full each month.

The Long-Term Payoff: Better Financing and Lower Insurance Costs

The responsible habits you build now will pay off massively in the future. When you graduate and need to secure financing for your first car, your strong credit score will be the difference between getting a loan with a 5% interest rate versus a 15% rate. That difference is enormous.

Furthermore, as mentioned earlier, your credit plays a role in your insurance costs. Many providers have found a strong correlation between responsible financial behavior and responsible behavior in other areas, like driving. By building a positive credit history, you are not only setting yourself up for better banking products, but you are also in a position to save money on essential services like auto insurance.

Conclusion

Building credit as a student is a proactive and powerful step towards achieving long-term financial wellness. It is a marathon, not a sprint, and it is built on a foundation of consistent, responsible habits, not complex financial maneuvers. By choosing the right first credit card, using it as a tool rather than a crutch, and understanding the critical importance of paying your bills on time, you can meticulously craft a strong financial reputation from the ground up.

This credit “passport” that you build during your university years will open doors long after you’ve graduated. It will lead to better financing opportunities, lower interest rates, reduced insurance costs, and ultimately, a more secure and empowered financial life.