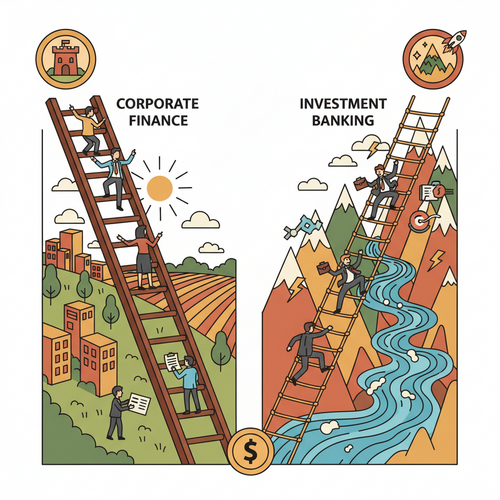

Navigating the intricate world of finance often leads to a crucial fork in the road: understanding the distinctions between Corporate Finance vs. Investment Banking. Both fields are highly coveted, offering intellectually stimulating challenges and significant earning potential. However, their daily functions, work environments, compensation structures, and long-term career trajectories diverge significantly. Aspiring finance professionals must grasp these fundamental differences to make informed decisions about their future.

This comprehensive guide will dissect each profession. We will explore their core responsibilities, delve into typical salary expectations, and map out potential career paths. Ultimately, this comparison aims to equip you with the knowledge necessary to determine which path aligns best with your personal and professional aspirations.

Understanding the Financial Landscape: Corporate Finance vs. Investment Banking

The financial industry is vast and multifaceted. Within its complex structure, corporate finance and investment banking represent two distinct, yet occasionally interconnected, pillars. Understanding their individual definitions provides a foundational insight into their roles.

What is Corporate Finance?

Corporate finance is the branch of finance dealing with the funding, capital structuring, and investment decisions of corporations. It focuses on maximizing shareholder value through long-term and short-term financial planning and the implementation of various strategies. Professionals in corporate finance primarily work within a company. Their overarching goal is to ensure the business operates efficiently and sustainably from a financial perspective.

Moreover, corporate finance encompasses activities such as financial analysis, budgeting, forecasting, capital allocation, and risk management. It is an integral function of any successful enterprise. Essentially, these teams act as the financial backbone of the organization.

What is Investment Banking?

Investment banking, conversely, is a specific division of banking that provides financial advisory services to corporations, governments, and other large entities. These services are typically related to raising capital or engaging in mergers and acquisitions (M&A). Investment bankers act as intermediaries. They facilitate complex financial transactions for their clients.

Furthermore, investment banks assist clients in issuing debt and equity securities. They also help with underwriting, managing initial public offerings (IPOs), and structuring private placements. They often operate on the sell-side of the market. Consequently, they serve as crucial advisors in high-stakes financial deals.

Diverging Roles and Responsibilities

While both corporate finance and investment banking demand strong analytical skills, their day-to-day responsibilities and overall objectives are markedly different. Understanding these roles helps clarify the operational distinctions between the two fields.

Corporate Finance: The Internal Financial Architect

Professionals in corporate finance are the internal financial architects of a company. Their primary focus remains inward. They manage the company’s financial health, performance, and strategy. Daily tasks often involve creating financial models, analyzing cash flow, preparing budgets, and evaluating potential investments. They ensure the company uses its capital effectively.

- Financial Planning and Analysis (FP&A): This involves budgeting, forecasting, and performance reporting. FP&A teams help management make informed decisions.

- Capital Budgeting: Evaluating and selecting long-term investment projects. For instance, deciding whether to invest in new equipment or expand into a new market.

- Treasury Management: Overseeing the company’s cash flow, liquidity, and risk management related to finances. This ensures adequate funds are available for operations.

- Investor Relations: Communicating with shareholders and the investment community. This maintains transparency and builds trust.

- Risk Management: Identifying, assessing, and mitigating financial risks that could impact the company.

Corporate finance roles often offer a more predictable work schedule. This is particularly true when compared to the demanding hours of investment banking. They are essential for a company’s operational stability and growth.

Investment Banking: The External Dealmaker

Investment bankers are the external dealmakers. They facilitate large-scale transactions between companies, or between companies and investors. Their work is project-based and client-focused. It often involves intense periods of activity leading up to a deal close.

- Mergers and Acquisitions (M&A): Advising companies on buying or selling other companies. This includes valuation, negotiation, and structuring deals.

- Capital Raising: Helping clients raise money through the issuance of stocks (equity) or bonds (debt). This might involve IPOs, secondary offerings, or private placements.

- Underwriting: Guarantees the sale of newly issued securities. Investment banks purchase the securities from the issuer and resell them to investors.

- Restructuring: Advising financially distressed companies. They help reorganize debt and operations to improve financial health.

Consequently, investment banking demands long hours and significant travel. Professionals in this field must possess exceptional presentation, negotiation, and quantitative skills. Their compensation often reflects the high-pressure, high-reward nature of their work.

Salary and Compensation: A Tale of Two Paths

When comparing Corporate Finance vs. Investment Banking, compensation is often a major differentiating factor. Both fields offer competitive salaries. However, investment banking typically boasts higher entry-level and overall compensation, primarily driven by substantial bonuses linked to deal flow and individual performance.

Corporate Finance Salary Expectations

Salaries in corporate finance are generally stable and offer a clear progression. Entry-level positions, such as financial analyst, might range from $60,000 to $80,000 annually. This figure excludes bonuses. Mid-career professionals, like finance managers or senior analysts, can expect to earn between $90,000 and $150,000.

Furthermore, director-level positions can command salaries upwards of $150,000 to $250,000 or more. This depends on the company size, industry, and location. Bonuses in corporate finance are typically a smaller percentage of base salary. They are often tied to company performance and individual metrics. While not as volatile as investment banking bonuses, they still represent a meaningful part of total compensation.

For more detailed insights into corporate finance roles and compensation, sources like Investopedia provide excellent overviews.

Investment Banking Compensation: High Risk, High Reward

Investment banking is renowned for its lucrative compensation packages, particularly the substantial bonuses. Entry-level analysts can expect total compensation (base salary plus bonus) ranging from $100,000 to $200,000, sometimes even higher in top-tier firms. Associates, who typically have an MBA or a few years of experience, often see total compensation between $200,000 and $400,000.

Moreover, as professionals advance to Vice President (VP), Director, or Managing Director (MD) roles, total compensation can easily reach into the mid-six figures, often exceeding $500,000 to over $1,000,000 annually. The bonus component in investment banking can frequently be 50% to 150% (or more) of the base salary. This significantly inflates the total take-home pay. This high compensation reflects the demanding hours, high-pressure environment, and direct impact on large financial transactions. The market also plays a crucial role. Strong deal activity translates to higher bonuses across the board.

Career Trajectories and Growth

The career paths in corporate finance and investment banking are distinct. They offer different types of growth, development, and exit opportunities. Understanding these trajectories is vital for long-term career planning.

Corporate Finance Career Path: Stability and Strategic Influence

A career in corporate finance typically offers a more structured and stable progression within a single company or across various corporations. Individuals often start as financial analysts. They then advance to senior analyst, finance manager, and ultimately director-level roles such as Director of FP&A or Treasury Director. The pinnacle of a corporate finance career is often the Chief Financial Officer (CFO) position. This role carries immense strategic influence and responsibility.

Furthermore, corporate finance professionals develop deep industry knowledge and play a direct role in the company’s operational and strategic success. This path emphasizes long-term growth, internal leadership, and a more predictable work-life balance compared to investment banking. It allows for the cultivation of strong relationships within the organization. The focus is on value creation through efficient internal financial management. Many corporate finance professionals value the opportunity to see their strategic decisions implemented over time.

Investment Banking Career Path: Fast-Paced Advancement and Exit Opportunities

The investment banking career path is known for its intense, accelerated learning curve and numerous “exit opportunities.” Analysts typically work for 2-3 years before moving on to an associate role, often after completing an MBA. Associates then progress to Vice President, Director, and eventually Managing Director. Each promotion comes with significantly increased responsibilities and compensation.

However, many investment bankers do not remain in the field long-term. The demanding hours and high-pressure environment often lead professionals to transition into other finance roles after a few years. Common exit opportunities include:

- Private Equity: Working for firms that invest in and acquire private companies. This leverages the M&A and valuation skills gained in banking.

- Hedge Funds: Managing investment portfolios for high-net-worth individuals and institutional clients. Analytical rigor is highly valued here.

- Corporate Development: Moving into a corporate finance role within a large company, specifically focusing on M&A and strategic investments for that corporation.

- Venture Capital: Investing in early-stage, high-growth companies. This path often attracts those with an entrepreneurial spirit.

- Startups: Taking on finance or operational roles within fast-growing companies, often leveraging deal-making experience.

The experience gained in investment banking is highly valued across the financial industry. Consequently, it opens many doors for ambitious professionals. For further exploration of investment banking careers, major financial news outlets like Reuters Deals often provide excellent market insights.

Key Skills and Educational Background

Both corporate finance and investment banking require a strong quantitative aptitude and a solid understanding of financial principles. Nevertheless, the emphasis on certain skills and the typical educational pathways can differ.

Essential Skills for Corporate Finance Professionals

Corporate finance roles often require a blend of analytical, strategic, and interpersonal skills. Professionals must be adept at understanding a company’s internal operations and external market dynamics.

- Financial Modeling and Analysis: Proficiency in building detailed financial models, forecasts, and valuation analyses.

- Budgeting and Forecasting: Ability to develop accurate financial plans and predict future performance.

- Communication Skills: Clearly articulating financial insights to non-finance stakeholders and senior management.

- Strategic Thinking: Contributing to the company’s overall business strategy through financial insights.

- Software Proficiency: Expertise in Excel, SAP, Oracle, and other enterprise resource planning (ERP) systems.

- Problem-Solving: Identifying financial challenges and developing practical solutions.

Many corporate finance professionals hold degrees in finance, accounting, or economics. An MBA or certifications like the CFA (Chartered Financial Analyst) are highly beneficial for career advancement. Education forms a strong base for these roles. Top business schools like the University of Chicago Booth School of Business are renowned for their finance programs.

Required Skills for Investment Bankers

Investment banking demands an exceptionally strong quantitative toolkit, coupled with robust salesmanship and resilience. The fast-paced, client-driven nature of the work necessitates a unique skill set.

- Advanced Financial Modeling and Valuation: Building complex models for M&A, LBOs (Leveraged Buyouts), and various valuation techniques.

- Presentation Skills: Creating compelling pitch books and effectively presenting to clients and senior bankers.

- Negotiation and Persuasion: Guiding clients through complex transactions and achieving favorable outcomes.

- Work Ethic and Resilience: The ability to work long hours under pressure and maintain attention to detail.

- Attention to Detail: Even minor errors can have significant financial implications in high-value deals.

- Networking: Building and maintaining relationships with clients and industry contacts.

Investment bankers typically possess undergraduate degrees in finance, economics, business, or even engineering. A Master of Business Administration (MBA) from a top-tier program is almost a prerequisite for advancement to associate level and beyond. Many pursue additional certifications to enhance their expertise.

Conclusion

In conclusion, the choice between Corporate Finance vs. Investment Banking hinges on individual career aspirations, desired work-life balance, and long-term professional goals. Investment banking offers a fast-paced, high-stress environment with significantly higher initial compensation and a multitude of exit opportunities. It is an excellent launchpad for a career in various aspects of financial markets, albeit with demanding hours.

Conversely, corporate finance provides a more stable, internal role. It allows professionals to deeply integrate with a company’s strategic direction and offers a more predictable work schedule, with a clear path to leadership positions like CFO. While compensation may start lower, it offers substantial growth and often a better work-life integration over the long term. Both paths demand rigorous analytical skills and a dedication to financial excellence. Your decision should align with your strengths, values, and vision for your professional life. Carefully consider the trade-offs. Ultimately, both fields are critical to the functioning of global commerce and offer rewarding careers for ambitious individuals.