Inflation and student loans represent a critical financial dynamic many borrowers overlook. Indeed, understanding how rising prices impact your financial obligations is essential. Therefore, this guide explains inflation’s mechanisms. Furthermore, it details its effects on your student loan debt. Consequently, you can make more informed financial decisions. Thus, let’s explore this vital economic relationship.

What is Inflation?

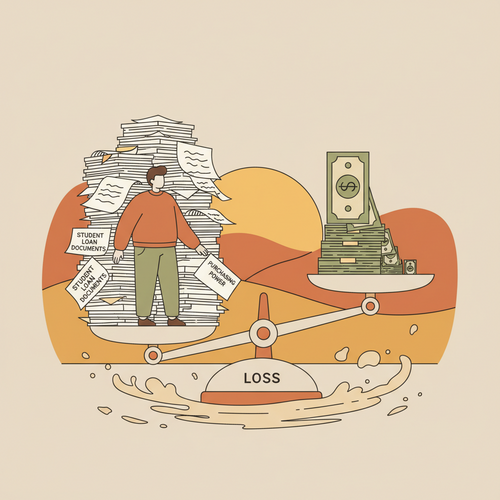

Inflation is a fundamental economic concept. Specifically, it refers to the general increase in prices. Moreover, it signifies a fall in the purchasing value of money. Therefore, your dollar buys less over time. Understanding this concept is crucial for financial planning. Indeed, it impacts everything from groceries to investments.

Defining Inflation

Defining inflation precisely helps clarify its role. Essentially, it is the rate at which prices for goods and services rise. Conversely, it is the corresponding fall in purchasing power. For instance, a loaf of bread costing $2 last year might cost $2.20 today. This increase reflects inflation’s presence. Thus, consumers experience higher costs. Furthermore, businesses face increased operational expenses. Consequently, these costs are often passed on to consumers.

Measuring Inflation

Economists measure inflation through various indices. The Consumer Price Index (CPI) is most common. Specifically, the CPI tracks changes in prices of a basket of consumer goods. This basket includes food, housing, and transportation. Consequently, a higher CPI indicates rising inflation. Another important measure is the Producer Price Index (PPI). The PPI tracks wholesale prices. Therefore, it can sometimes predict future consumer inflation. Indeed, these metrics provide vital economic insights. Thus, they guide monetary policy decisions.

Understanding Purchasing Power

Purchasing power directly relates to inflation. Simply put, it is the value of a currency. Specifically, it represents the amount of goods and services one unit of money can buy. When inflation rises, purchasing power falls. Therefore, your money loses value. Consequently, this erosion significantly impacts savings and debt. Indeed, it subtly affects your financial future. Thus, protecting purchasing power is key.

How Purchasing Power Erodes

The erosion of purchasing power is a gradual process. Initially, small price increases seem negligible. However, over months and years, these increases accumulate. For instance, a dollar saved today will buy less in a decade. This phenomenon shows why saving in a low-interest account can be detrimental. Conversely, assets that outpace inflation help maintain wealth. Thus, protecting your purchasing power becomes a key financial goal. Furthermore, understanding this erosion motivates sound investment strategies.

The Impact on Student Loans

Inflation’s effect on student loans is multifaceted. Many borrowers assume their debt remains static. However, inflation alters the real value of that debt. Specifically, it can make repayments feel heavier or lighter. Therefore, understanding this dynamic is crucial for borrowers. Indeed, it influences long-term financial planning. Consequently, strategic adjustments might be necessary. Thus, a nuanced approach is beneficial.

Fixed vs. Variable Rates

Student loans typically have either fixed or variable interest rates. Fixed-rate loans maintain the same interest rate throughout repayment. For instance, a 5% fixed rate stays 5%. Therefore, your monthly payment amount remains constant. In contrast, variable-rate loans have fluctuating interest rates. These rates often tie to a benchmark. Consequently, your payments can increase or decrease. Specifically, during periods of high inflation, variable rates often rise. This rise can significantly increase your monthly burden. Thus, understanding your loan type is paramount. Indeed, it impacts your budgeting decisions.

Real Value of Debt

Inflation affects the real value of your student loan debt. The nominal amount you owe stays the same. For example, a $30,000 loan remains $30,000. However, the purchasing power of that $30,000 changes. As inflation increases, the dollars you use to repay become “cheaper.” Therefore, the real burden of your debt decreases. This concept is often called “inflating away” your debt. Conversely, if wages do not keep pace, this benefit is negated. Indeed, high inflation combined with stagnant wages can be challenging. Thus, a balanced perspective is necessary. Moreover, it highlights the importance of wage growth aligning with inflation.

Strategies for Students

Managing student loans during inflationary times requires strategy. Proactive measures can mitigate negative impacts. Therefore, consider several approaches. Specifically, these include budgeting, exploring refinancing, and utilizing repayment plans. Indeed, thoughtful financial planning empowers borrowers. Consequently, you can navigate economic shifts more effectively. Thus, informed action is key.

Key Strategies to Consider:

- Budgeting and Savings: Implement strict budgeting. Track all income and expenses. Identify areas for spending reduction. Build an emergency fund for stability. Allocate extra funds to high-yield savings or inflation-protected assets. Consequently, every saved dollar fights purchasing power erosion.

- Refinancing Considerations: Evaluate refinancing your student loans. If interest rates are low, consider switching to a lower fixed rate. This offers payment predictability. However, during high inflation, new variable rates might climb. Therefore, assess the current economic climate thoroughly. Specifically, compare offers from multiple reputable lenders. Reuters offers valuable financial news. Always consider your credit score and financial stability before committing. Indeed, a lower rate can save thousands over the loan’s life. Thus, research and due diligence are crucial.

- Income-Driven Repayment Plans: Explore federal income-driven repayment (IDR) plans. These adjust your monthly payment based on income and family size. During inflationary periods, if income growth lags expenses, IDR plans offer essential flexibility. Therefore, payments remain manageable. For instance, PAYE or REPAYE cap payments at a percentage of discretionary income. Bloomberg provides economic insights affecting incomes. Furthermore, any remaining loan balance can be forgiven after 20-25 years. Indeed, this offers significant relief. Thus, investigate these plans if you qualify.

- Investing for Growth: Beyond savings, consider investing in assets that historically outperform inflation. For example, diversified stock market investments or real estate can offer long-term growth potential. Therefore, consulting a financial advisor is often beneficial. Specifically, they can help tailor a strategy to your risk tolerance. Consequently, your investments can help offset the erosion of purchasing power. Thus, strategic investing is another valuable tool.

Conclusion

Inflation directly impacts the real cost of your student loans. It erodes purchasing power over time. Therefore, understanding this relationship is paramount. Specifically, it empowers you to make informed decisions. Consider your loan types and interest rates. Furthermore, explore strategies like budgeting and refinancing. The Wall Street Journal offers expert financial analysis. Indeed, proactive financial management can mitigate inflation’s effects. Ultimately, protecting your financial future is about knowledge and action. Thus, stay informed and plan wisely. Consequently, you build financial resilience.