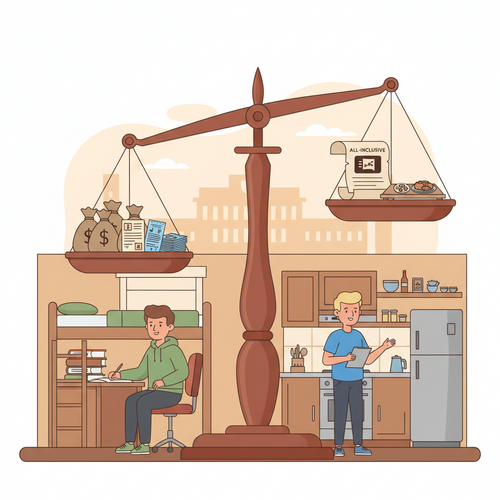

Deciding where to live during college is a massive decision that impacts your daily life. It is not just about comfort; it affects your financial future. When comparing Off-Campus Housing vs Dorms, students must analyze more than just the monthly rent. This guide breaks down the true costs, helping you make a smart choice for your budget. Consequently, taking the time to compare all options now saves a lot of stress and money later.

Many students jump into a housing contract without fully understanding the long-term impact on their savings. However, proactive financial planning allows you to avoid the common pitfalls of student living. In my experience, the choice between Off-Campus Housing vs Dorms often determines whether a student graduates with manageable debt or a financial burden. Therefore, we will explore the hidden expenses and benefits of both worlds.

Quick Summary: Your Housing Decision Simplified

- 💰 Dorms offer predictability: All-inclusive bills simplify your monthly budget with fewer hidden costs.

- 🏠 Off-campus can save money: This option often provides lower rent but demands more responsibility and higher upfront costs.

- ⚖️ Your lifestyle matters: The balance between convenience and control dictates the best financial fit for your situation.

The True Cost of Dorm Life

Dorms often seem like the easiest option for new students, and for good reason. Universities bundle many essential services into one single payment. This structure can feel less daunting because it eliminates the need to manage multiple vendors. However, that convenience comes with a significant price tag. Sometimes, you pay for premium amenities that you barely use, such as a full-tier meal plan.

When you sign up for campus housing, you receive a package deal. This typically includes your rent, utilities, internet, and a mandatory meal plan. The biggest advantage of this model is budgeting simplicity. Consequently, you know your housing costs upfront for the entire semester. This fixed expense makes financial planning much more straightforward because you never have to worry about unexpected utility spikes during the winter months.

Advantages and Disadvantages of On-Campus Living

- ✅ All-Inclusive Bills: You make no separate payments for electricity, water, or Wi-Fi.

- ✅ Built-in Security: Professional campus security teams often patrol dorm areas 24/7.

- ✅ Proximity to Classes: Shorter commutes save you both time and transportation costs.

- ❌ Less Personal Space: You often deal with smaller rooms and crowded common areas.

- ❌ Mandatory Meal Plans: These can be expensive, especially if you rarely eat in the dining hall.

Pro Tip: Read the Fine Print! Always review what your dorm fees actually include. Some universities charge extra for laundry facilities, specific high-speed internet, or even basic furniture like desks. Therefore, you should never assume any service is free just because you live on campus.

Unpacking Off-Campus Housing vs Dorms Expenses

Moving into an apartment can initially appear cheaper, but it requires a very careful calculation. When you live off-campus, you assume responsibility for managing many different bills. This means you perform more administrative work, but you also gain more control over your spending habits. Rent is only the starting point of your monthly expenses.

In the Off-Campus Housing vs Dorms debate, off-campus living offers immense flexibility. You can pick your own roommates, choose your apartment size, and select a preferred location. This freedom often translates into potential savings if you are willing to live further from the city center. However, it also means you face a steeper learning curve in financial management. Budgeting for variable costs like electricity and heating becomes a critical skill for survival.

Pros and Cons of Living Off-Campus

- 🏡 More Space & Privacy: You often enjoy larger living areas and private bathrooms.

- 🍔 No Mandatory Meal Plans: You can cook your own food and save hundreds of dollars each month.

- 💡 Cost-Saving Potential: Off-campus life is often cheaper than dorms if you plan carefully.

- ⚠️ Variable Utility Bills: You must pay for electricity, gas, water, and trash separately.

- ⚠️ High Upfront Costs: You need to save for security deposits and application fees.

- ⚠️ Transportation Needs: You might need to pay for bus passes, gas, or campus parking permits.

The Hidden Costs You Might Forget

Beyond the obvious rent and utilities, both options have sneaky costs that most students ignore. Ignoring these can derail your carefully planned budget. You must always think about the “little” things that add up over a semester. For dorms, think about the extra fees for early move-in dates. Off-campus, you must consider the high cost of furnishing an empty space.

Dorm Specific Hidden Costs:

You might need to buy specific bedding, mini-fridges, or specialized storage solutions that only fit in small dorm rooms. Furthermore, laundry facilities on campus often require payment per load. These small expenses accumulate quickly over several months. Even though the university covers your main meals, you will likely still buy snacks or coffee. Consequently, that daily caffeine habit can quickly blow your “all-inclusive” budget.

Off-Campus Specific Hidden Costs:

Furnishing an entire apartment from scratch is an expensive endeavor. You will need essentials like a bed, a sofa, and basic kitchenware. While buying second-hand items helps, it still represents a significant initial investment. Additionally, do not forget renter’s insurance, which many landlords now require. You should also account for internet installation fees or pet deposits if you plan to bring a companion.

For more insights into managing your student finances effectively, you can check reputable resources like Bloomberg or Forbes. These platforms offer excellent tools for calculating the long-term impact of housing debt.

Financial Comparison Table: Off-Campus Housing vs Dorms

| Feature | On-Campus Dorms | Off-Campus Housing |

|---|---|---|

| Rent Structure | Often per semester, bundled | Monthly, separate from utilities |

| Utilities | Usually included in fee | Separate, variable monthly bills |

| Internet & TV | Often included in package | Separate monthly subscription |

| Meal Plan | Mandatory (often expensive) | Optional, self-managed groceries |

| Security Deposit | Rarely required | Commonly 1-2 months’ rent |

| Furniture | Provided by school | You provide (upfront cost) |

| Transportation | Walk to classes (minimal cost) | Bus pass, gas, or parking |

| Lease Length | Academic year (9 months) | Typically 12 months |

| Emergency Fund | Lower need | Higher (for repairs/spikes) |

Making Your Best Financial Decision

The “cheaper” option is not always obvious at first glance. Your personal lifestyle and financial discipline play a huge role in the final outcome. You should think about your cooking habits, your social life, and your commute preferences. If you prefer a hands-off approach to budgeting, dorms might offer the peace of mind you need. However, if you are ready for more responsibility, Off-Campus Housing vs Dorms analysis often favors an apartment.

Consider creating a detailed budget for both scenarios. List every potential income source and every possible expense. This hands-on exercise often reveals surprising differences that a simple mental calculation misses. Furthermore, you should talk to older students who have experienced both. Their real-world advice can be invaluable for spotting overlooked regional costs. For more budgeting tools, you can explore sites like Investopedia or NerdWallet.

Warning: Don’t Underestimate Time Commitment! Managing an apartment takes a lot of time. You must handle bill payments, cleaning, grocery shopping, and communication with landlords. You should factor this “time cost” into your decision, especially if you have an extremely demanding academic schedule. Therefore, convenience is sometimes worth the extra money.

Long-Term Wealth and Independence

Remember, your first year of college might require a different strategy than your senior year. It is perfectly okay to start in a dorm and transition to an apartment later. This adaptability is a valuable financial skill that serves you well throughout life. Ultimately, the best choice aligns with your current budget, your comfort level, and your independence goals. You must prioritize what gives you the most value for your money during these critical years.

For broader economic trends affecting the national housing market, you should visit the Wall Street Journal. Keeping an eye on inflation and rent prices helps you predict how your costs might change over the next four years. Consequently, you will be better prepared for the transition into the professional world after graduation.

Conclusion

Both off-campus housing and dorms present unique financial profiles. Dorms offer convenience and predictability, while off-campus living provides potential savings and greater independence. Your personal financial habits and willingness to manage multiple responsibilities will determine which option is more cost-effective. By analyzing Off-Campus Housing vs Dorms today, you are taking a major step toward a stable financial future. What unexpected costs have you encountered in college housing, and how did you manage them?