Introduction

Life is full of moments when a large sum of money could be incredibly helpful. Perhaps you’re facing an unexpected medical bill. Maybe a critical home repair can’t wait. Or you see an opportunity to simplify your finances. In these situations, a personal loan often presents itself as a flexible financing tool. Unlike a car loan or mortgage, you can use these funds for almost any purpose. However, this flexibility is a double-edged sword. A personal loan can be a strategic tool. It can also be a fast track to a heavy debt burden. The outcome depends entirely on how you use it.

This article is your comprehensive guide to understanding personal loan financing. We will explore the smart ways to use a personal loan, such as for consolidating high-interest debt. We will also cover the situations you should absolutely avoid. Additionally, we will break down the critical role your credit score plays. We’ll also explain the monumental impact of the interest rate. Finally, we’ll cover the fine print, including optional insurance, that you must understand.

What is a Personal Loan and How Does it Work?

At its core, an unsecured personal loan is a straightforward financial product. A lender, like a bank or credit union, gives you a lump sum of money. In return, you agree to pay it back in fixed monthly installments over a predetermined period. This period is called the “term,” and it typically ranges from two to seven years. Each payment consists of a portion of the principal (the amount you borrowed). The rest of the payment is interest (the cost of borrowing). Because it is “unsecured,” you do not have to put up any collateral, like your car or your house.

The Smart Uses: When a Personal Loan Makes Sense

A personal loan is a powerful tool when you use it for a clear, strategic purpose. Ideally, it should improve your financial position in the long run.

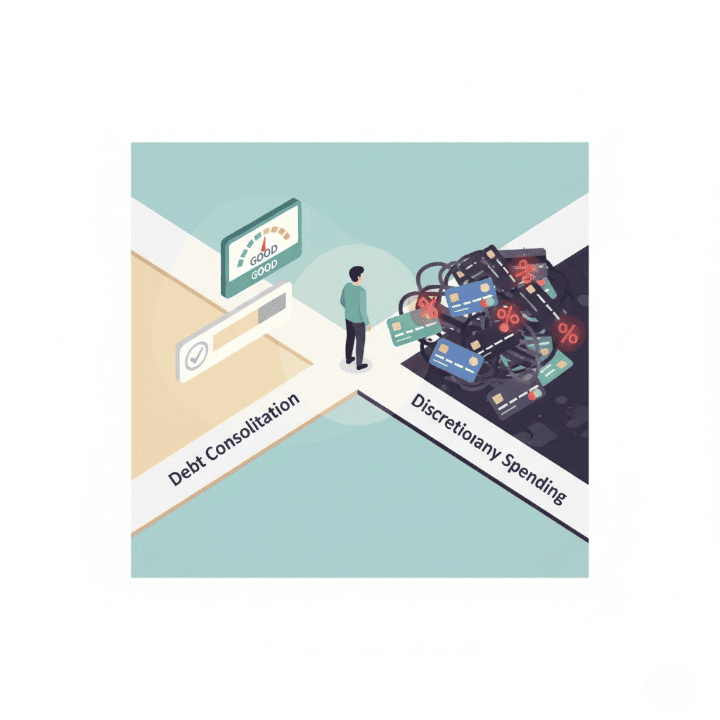

- Debt Consolidation: This is arguably the best and most common smart use for a personal loan. Imagine you have balances on multiple credit card accounts. Each card has a high interest rate of 20% or more. This makes it feel impossible to get ahead. You could take out a single personal loan with a much lower interest rate, for example, 10%. You would then use this loan to pay off all of those credit cards at once. This action simplifies your life with a single monthly payment. More importantly, it can save you thousands of dollars in interest. This allows you to get out of debt years faster.

- Major Unexpected Expenses: Even with a good emergency fund, some costs can be overwhelming. A personal loan can be a responsible way to handle a large, urgent, and non-negotiable expense. This could include a major home repair, like a new roof, after a storm. It could also cover a significant, unexpected medical bill that your health insurance doesn’t fully cover.

The Traps: When to Avoid a Personal loan

The danger of personal loans lies in using them to fund a lifestyle you cannot afford. You should almost always avoid taking out a loan for discretionary or speculative purposes.

- Funding a Lifestyle: Financing a vacation, luxury goods, a wedding, or other non-essential purchases with a loan is a classic debt trap. It creates a long-term payment for a short-term pleasure.

- Risky Investments: Never take out a personal loan to invest in the stock market or other speculative ventures. You are borrowing at a guaranteed interest rate to chase an uncertain return, which is an extremely risky gamble.

- “Debt Shuffling”: Taking out a debt consolidation loan is only a good idea if you also commit to changing your spending habits. If you pay off your credit card balances with a loan but then immediately start running them up again, you haven’t solved the problem. In fact, you have only deepened it.

Your Credit Score: The Key to Approval and a Low Interest Rate

Your credit score is the most important factor in the personal loan process. Before a lender considers your application, they will perform a hard credit inquiry. This lets them review your financial history. Your score will determine two critical things: approval and your interest rate.

A higher credit score signals to lenders that you are a reliable borrower. This directly translates to a lower interest rate. The difference can be substantial. For example, a borrower with excellent credit might get a 7% interest rate on a loan. A borrower with fair credit might be offered the same loan but at 18%. On a $10,000 loan over five years, that difference can mean paying thousands of extra dollars in interest. This is why it’s so important to check your credit report for errors and improve your score before applying.

The Fine Print: Understanding Loan Insurance and Fees

When a lender offers you a personal loan, they might also offer an optional product. This is often called “credit insurance” or “payment protection insurance.” This insurance is designed to make your loan payments for a period if you lose your job or become disabled. While it sounds like a good safety net, this insurance is often very expensive for the coverage it provides. It is a high-profit product for lenders. In most cases, you are better off focusing on building a robust emergency fund. An emergency fund gives you the same protection without the extra monthly cost.

You should also be aware of “origination fees.” Some lenders charge this fee for processing the loan. They typically deduct it from the loan amount before you receive the funds. Always factor this fee in when comparing different loan offers.

Conclusion

A personal loan is a powerful financing tool, but it is not free money. It is a serious financial commitment. Therefore, you must approach it with a clear and strategic purpose. The key is to use it to improve your financial situation, not just to enable more spending.

By focusing on smart uses, like consolidating high-interest rate credit card debt, you can leverage a personal loan to your advantage. By diligently building your credit, you can qualify for the best terms. Finally, by carefully reading all the fine print, including clauses about fees and insurance, you can use this financial product to improve your financial health, not harm it.