Introduction

After years of hard work, you’ve finally done it. You’ve walked across the stage, diploma in hand, and landed your first full-time job. That first paycheck hits your bank account, and it feels like a monumental amount of money compared to the tight budget of your university days. Immediately, your mind starts racing with possibilities: a nicer apartment in a better neighborhood, a new car, trendier clothes, and dinners out without checking your bank balance first. This is the moment where you face one of the most silent and effective traps in personal finance: lifestyle inflation.

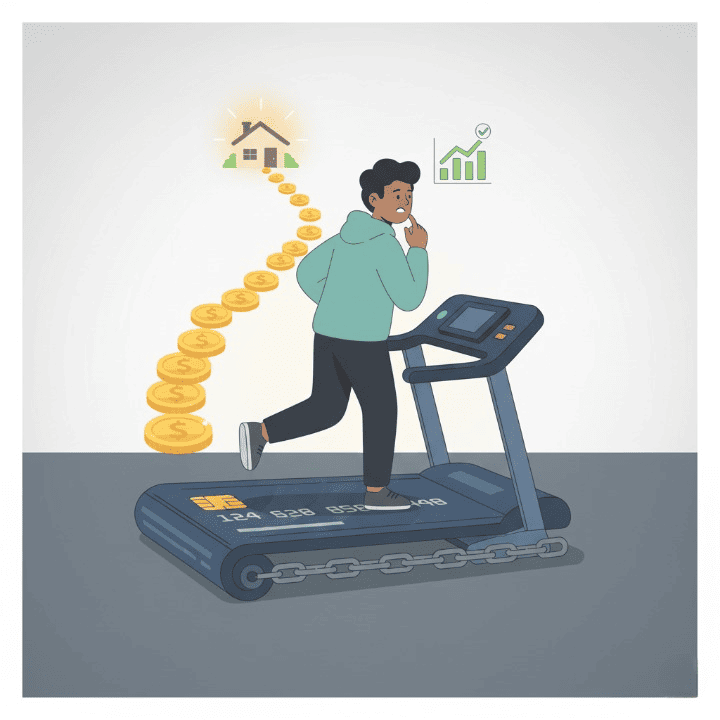

Lifestyle inflation is the subtle, almost unconscious tendency for your spending to increase in lockstep with your income. While it feels like natural progress, it is the primary reason why many people with good salaries still live paycheck to paycheck, build little to no real wealth, and feel constantly stressed about money. This article is your guide to recognizing and avoiding this common pitfall. We will explore the psychology behind lifestyle inflation and provide a clear, actionable strategy to ensure your new income builds a foundation for financial freedom, not just a more expensive version of the same financial hamster wheel.

What is Lifestyle Inflation (And Why is it So Tempting?)

Lifestyle inflation, also known as “lifestyle creep,” is the phenomenon where your standard of living improves as your income rises, leaving your savings rate dangerously stagnant. As you earn more, your definition of what constitutes a “necessity” begins to expand. The daily coffee you used to make at home becomes a non-negotiable purchase from a cafe. Your reliable old car suddenly feels embarrassing.

This is incredibly tempting for new graduates for several powerful reasons:

- The Feeling of “Deserving It”: After years of academic sacrifice and living on a shoestring, there is a powerful feeling that you have earned the right to enjoy the fruits of your labor immediately.

- Social Pressure: In the age of social media, the pressure to “keep up” is immense. You see your friends and colleagues posting pictures of new cars, apartments, and vacations, and you feel a powerful urge to project the same image of success.

- Lack of a Plan: This is the biggest factor. Without a clear financial plan for your new income, the money has no direction. It is naturally and almost unconsciously absorbed by mindless, incremental increases in spending across every category of your life.

While there is nothing wrong with enjoying your money, unchecked lifestyle inflation can quickly consume your entire salary increase, leaving you with nothing to show for it but a more complicated and expensive set of monthly bills.

The Primary Culprit: The Upgraded Credit Card

For many new graduates, a higher income means immediate access to a higher-end credit card with a significantly larger credit limit. While this can be a useful tool, it also acts as the primary enabler of lifestyle inflation. A larger credit limit can create a dangerous psychological permission slip, making you feel richer than you actually are and encouraging you to spend more.

This is where the danger becomes acute. Lifestyle inflation is often financed by this newfound credit. You might put a new sofa or a vacation on your credit card, telling yourself you’ll pay it off “soon.” But as your spending increases across the board, it becomes harder and harder to clear the balance. This is when you fall into the devastating trap of the high interest rate. A lifestyle funded by high-interest debt is not an upgrade; it is a financial cage. That $3,000 trip, if you only make minimum payments, can end up costing you over $4,000, severely damaging your financial health.

The True Cost: How Lifestyle Inflation Damages Your Credit and Future

The immediate effect of lifestyle inflation is a lower savings rate, but the long-term damage is far more severe.

- It Harms Your Credit: As you spend more, your credit card balances are likely to rise. This increases your credit utilization ratio—the amount of your available credit that you are using. This ratio is a major factor in determining your credit score. A high utilization ratio signals financial stress to lenders and can significantly lower your score, making future borrowing more expensive.

- It Delays Major Life Goals: This is the devastating opportunity cost. Every dollar you spend on an unnecessary upgrade is a dollar that you are not putting toward your real goals. Consider a new graduate with an extra $500 per month. One person might spend it on a more expensive car payment and rent. Another might invest it. Over ten years, that $500 per month invested could grow to over $80,000. Lifestyle inflation steals from your future self to satisfy a temporary want in the present. It directly hinders your ability to secure financing for the things that build lasting wealth, like a down payment on a house.

The Antidote: A ‘Pay Yourself First’ Strategy and Intentional Upgrades

The most effective way to combat lifestyle inflation is to make a conscious plan for your new income before it even hits your bank account. The strategy is simple and powerful: Pay Yourself First. Before you pay your rent, your bills, or buy a single coffee, the first “bill” you should pay is to your future self.

- Automate Your Savings and Investments: Decide on a percentage of your income you want to save (aim for at least 15-20% of your gross income). Set up an automatic transfer from your checking account to your savings and investment accounts for the day after you get paid.

- Maximize Your Retirement Contributions: If your employer offers a retirement plan with a match, your absolute first priority should be to contribute enough to get the full match. This is a 100% return on your money and is non-negotiable.

- Live Off the Rest: After your savings and investments are automatically taken care of, the money left over is what you have available for your lifestyle.

This doesn’t mean you can’t improve your life. The key is to be intentional with your upgrades. Instead of letting your spending creep up everywhere, choose a few “smart upgrades” that provide real, lasting value. A smart upgrade could be moving to a safer apartment closer to work, investing in professional development, or choosing a better health insurance plan during open enrollment. Prioritizing a comprehensive insurance package that protects your health and income over a luxury item is a clear sign of financial maturity.

Conclusion

Your first full-time salary is a powerful tool with incredible potential. The silent trap of lifestyle inflation can steal that potential, leaving you running on a fancier hamster wheel but never truly getting ahead in your financial life. By creating a conscious and intentional plan for your money, prioritizing saving and investing above all else, and making deliberate choices about your spending, you can decisively avoid this common pitfall.

Use your new income to buy your financial freedom, not just more things. This disciplined approach will protect your credit, accelerate your ability to secure financing for your major life goals, and ensure that your hard-earned money builds a truly wealthy, secure, and less stressful life.